what is total equity gross minority interest|Non : iloilo In simple words, Minority interest is the value of a share or the interest attributable to the shareholders holding less than 50% of the . Experience the thrill of international sports betting and casino gaming at your fingertips with Mostbet. Download our app now and take advantage of our welcome bonus and other promotions available for new customers.

what is total equity gross minority interest,Minority interest, also referred to as non-controlling interest (NCI), is the share of equity ownership in a subsidiary’s equity .

In simple words, Minority interest is the value of a share or the interest attributable to the shareholders holding less than 50% of the .

Minority interest, also known as non-controlling interest, refers to the portion of a company's equity that is owned by shareholders who do not have control .

Minority interest arises when a parent company owns less than 100% of a subsidiary. It represents the portion of the subsidiary's equity that is not owned by the parent. Understanding minority interest is .

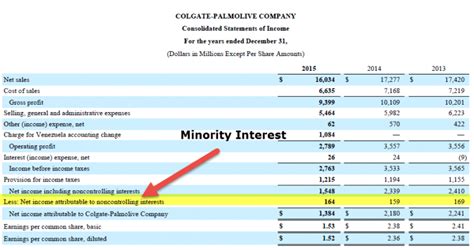

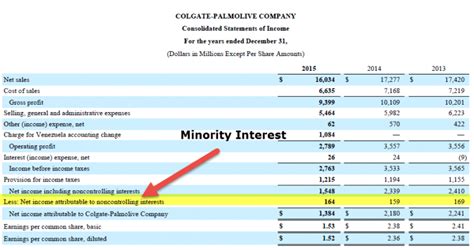

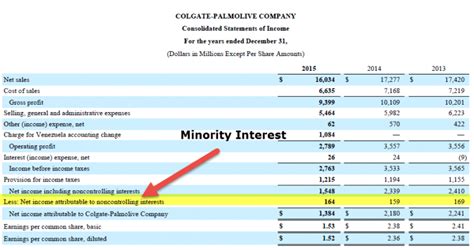

Enterprise Value = Market value of common stock + Market value of preferred equity + Market value of debt + Minority interest – Cash. What is Minority Interest .

Minority Interest refers to the portion of a subsidiary company's stock that is not owned by the parent company. Specifically, it is the equity stake held by non-controlling shareholders. Some key .

A non-controlling interest, also known as a minority interest, is an ownership position in which the shareholder owns less than 50% of outstanding shares. Minority interest shareholders.what is total equity gross minority interestTo determine the Minority Interest amount, use the following formula: Minority Interest = (Non-controlling Interest Equity/Total Equity) x Total Equity. Sourcetable can be used .

Minority interest, also referred to as non-controlling interest (NCI), is the share of ownership in a subsidiary’s equity that is not owned or controlled by the parent . Before 2008, companies reported minority interest as equity or noncurrent liabilities under GAAP (Generally Accepted Accounting Principles) rules, per the US. . Total Equity. $650,000. .

Minority interest refers to the ownership interest in a subsidiary, which is not owned by the parent company. Consolidated shareholder's equity is a financial metric that shows the total equity of a company and its subsidiaries. Minority interest can have a significant impact on consolidated.

A minority interest, also called a non-controlling interest (NCI), is the portion of a subsidiary company that is not owned by the parent company, either directly or indirectly through another group company. . Total assets – Total Liabilities. . (IFRS), minority interest is shown at the bottom of the equity section within the consolidated .

Minority interest in enterprise value shares held by minority shareholders in a fully consolidated subsidiary. It is a significant but non-majority interest (less than 50%). To . of equity in majority-owned subsidiaries not attributable to Nestle's shareholders is recorded on a separate line in total equity.

The company's balance sheet that includes a minority interest will show this information in the equity section of the balance sheet. The balance sheet for a company with a minority interest should be prepared on a book value basis rather than on a historical cost basis. In general, a minority interest should be valued at its fair value. It . A non-controlling interest, also known as a minority interest, is an ownership position in which the shareholder owns less than 50% of outstanding shares.

Then, calculate the Minority Interest percentage by dividing the Minority Interest amount from the Total Equity. To determine the Minority Interest amount, use the following formula: Minority Interest = (Non-controlling Interest Equity/Total Equity) x Total Equity. Sourcetable can be used to easily calculate Minority Interest.what is total equity gross minority interest Non Types of Minority Interest. Minority interest can be categorized based on the level of influence and control exerted by the minority shareholders. These categories help in understanding the varying degrees of involvement and impact on the company’s operations and financial decisions. Passive Minority Interest

present minority interest separately from liabilities and the equity of the parent’s shareholders. Thus, under AS minority interest is not presented as part of equity. NCI can be categorised as: • Present ownership interests that entitle their holders to a proportionate share of the entity’s net assets in liquidation (ordinary NCI)

Nonpresent minority interest separately from liabilities and the equity of the parent’s shareholders. Thus, under AS minority interest is not presented as part of equity. NCI can be categorised as: • Present ownership interests that entitle their holders to a proportionate share of the entity’s net assets in liquidation (ordinary NCI)We would like to show you a description here but the site won’t allow us. Minority interest, also referred to as non-controlling interest (NCI), is the share of ownership in a subsidiary’s equity that is not owned or controlled by the parent corporation. The parent company has a controlling interest of 50 to less than 100 percent in the subsidiary and reports financial results of the subsidiary consolidated with its own . When it comes to equity accounting, minority interest is an important aspect that cannot be overlooked. Minority interest in a company refers to the portion of a subsidiarys equity that is not owned by the parent company. Minority interest is important because it represents the ownership interest of non-controlling shareholders in a .Minority Interest: TL;DR. Minority interest, also known as 'non-controlling interest', represents the portion of a subsidiary company's equity that is not owned by the parent company. It is the share of profit and loss attributed to shareholders who own less than 50% of a company's equity. Minority Interest = Subsidiary’s Net Income × . The minority interest equity method refers to the accounting treatment for a company that has an ownership stake between 21-49% in another company. This level of ownership is considered an "active" minority interest, meaning the investing company can influence the financial and operating policies of the investee company, but does not have .What is Minority Interest? A minority interest is less than 50 per cent ownership or interest in a company. The word can apply to either stock ownership or a shareholding interest in a company. An investor or other entity other than the parent company holds a minority interest in a company. Minority interests usually come with some of the . Minority interests typically represent the stake in a company held by entities other than the parent company. Ranging between 20% and 30% of a company’s equity, these interests come with limited decision-making powers compared to the majority stakeholders, often the parent company.

ASC 810-10-20 defines a noncontrolling interest as the “portion of equity (net assets) in a subsidiary not attributable, directly or indirectly, to a parent” and further states that a “noncontrolling interest is sometimes called a minority interest.” This definition applies to all entities that prepare consolidated financial statements. Apa itu: Kepentingan minoritas (minority interest) mengacu pada sebagian kecil pemegang saham di perusahaan di mana lebih dari 50% kontrol dipegang oleh perusahaan induk. Karenanya, kepemilikan mereka kurang dari 50%. Juga disebut dengan kepentingan non-pengendali (non-controling interest)Kepentingan minoritas dalam .

what is total equity gross minority interest|Non

PH0 · Understanding minority interest

PH1 · Non

PH2 · Minority interest: Understanding Minority Interest in Shareholders: Equity

PH3 · Minority interest: Understanding Minority Interest in Shareholders:

PH4 · Minority Interest: Finance Explained

PH5 · Minority Interest: Definition, Types, and Examples

PH6 · Minority Interest in Enterprise Value Calculation

PH7 · Minority Interest Calculation Formula: Accounting

PH8 · Minority Interest (Meaning, Valuation)

PH9 · How to Calculate Minority Interest

PH10 · How To Calculate Minority Interest